Overview

In the highly regulated world of banking, "close enough" isn't good enough. When a major banking group needed to query complex ESG and financial reports, they found that standard RAG systems crumbled under the weight of dense tables, multi-hop reasoning, and cross-document KPIs. By partnering with Lettria, they deployed a hybrid GraphRAG solution that turned unstructured PDFs into a structured, transparent, and high-performing knowledge engine.

- Industry: Banking & Financial Services

- Scale: 45+ Reports | 15,000+ Pages

- Key Tech: Lettria Knowledge Studio, GraphRAG, Neo4j, Qdrant, VLM (Vision-Language Models)

The Challenge: The Limits of Standard RAG

Financial and ESG (Environmental, Social, and Governance) reports are notoriously difficult for AI to process. They are packed with:

- Complex Layouts: Multi-column text, nested tables, and intricate charts.

- Multi-Constraint Queries: Questions requiring the system to link data points across different chapters or documents.

- Numerical Precision: A high risk of hallucinations when interpreting financial KPIs.

The client’s existing chunk-only RAG systems failed to provide the answer completeness and auditability required for regulated financial analysis. They needed a system that didn't just "search" for text, but "understood" the relationships between entities.

The Solution: Why Lettria?

Lettria was selected for its unique end-to-end GraphRAG approach. Unlike "black box" solutions, Lettria provides a transparent pipeline that combines:

- Advanced Parsing: Layout-aware extraction that treats tables and charts as structured data, not just text blobs.

- Ontology-Driven Extraction: A text-to-graph methodology that maps information directly to a custom financial/ESG ontology.

- Hybrid Retrieval: A "best of both worlds" engine that uses Vector search (Qdrant) for semantic similarity and Graph search (Neo4j) for complex, multi-hop reasoning.

The Methodology: A 4-Month Co-Construction

The project was structured as a deep collaboration between Lettria’s engineers and the bank’s subject matter experts.

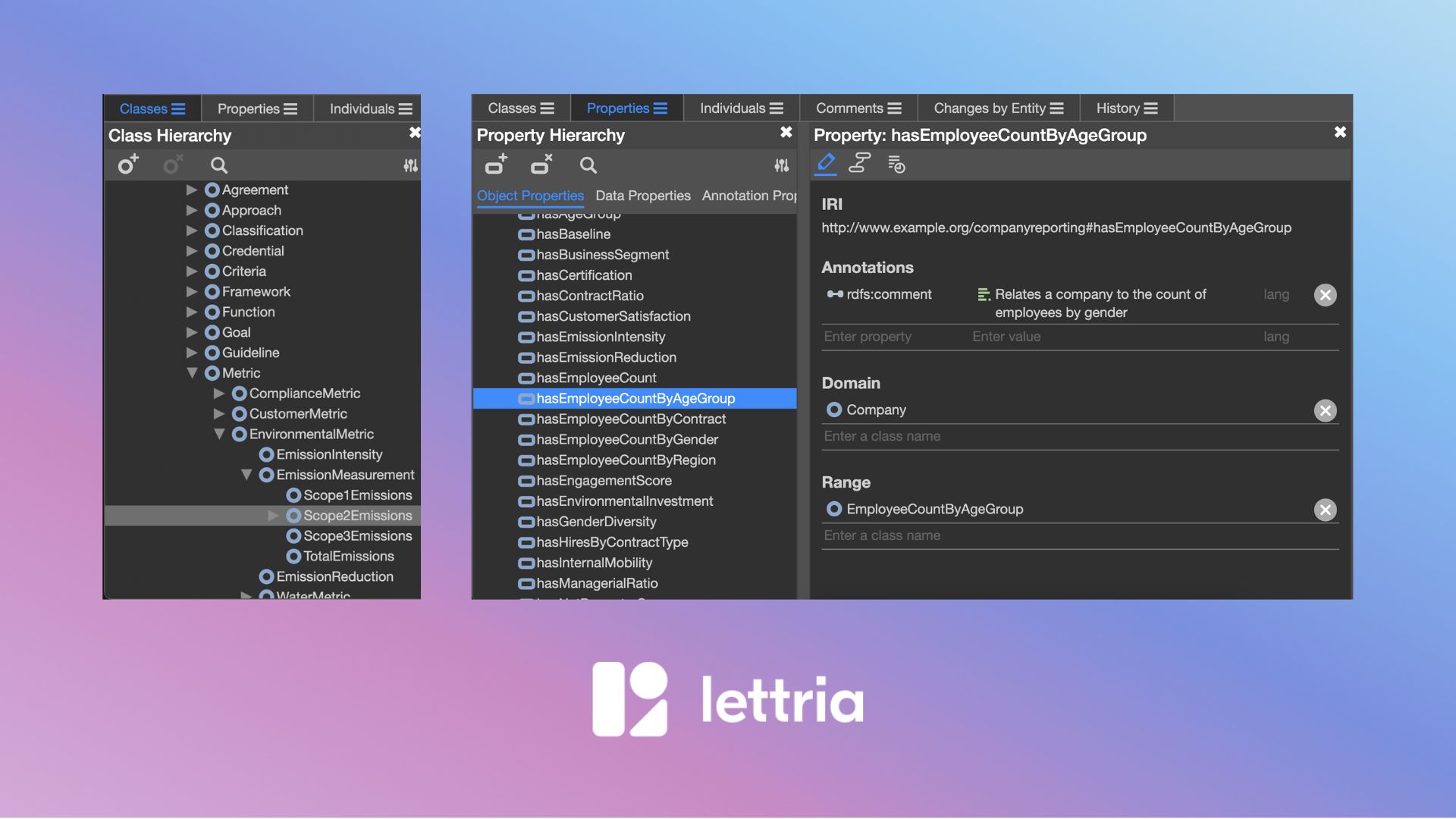

1. Strategy & Ontology Design

We began by defining the "Rules of the World." Through iterative workshops, we designed an RDF/Turtle ontology to capture specific ESG KPIs and financial relationships.

2. Technical Implementation & Parsing

The pipeline integrated OCR and layout-aware parsing. To handle visual data:

- 80% of chart indicators were captured via lightweight OCR of legends.

- 20% of complex visual data was processed using Vision-Language Models (VLM) for full image transcription.

3. The Knowledge Studio Experience

Transparency was the cornerstone of the project. The client was granted direct access to Lettria’s Knowledge Studio, allowing them to:

- View concrete text-to-graph outputs (RDF examples).

- Trace exactly which document and which "node" in the graph contributed to an answer.

- Compare different RAG configurations in real-time.

Project Milestones

- Phase 1: Setup & Success Criteria alignment.

- Phase 2: Development of the text-to-graph extraction pipeline and hybrid retrieval tuning.

- Phase 3: Blinded internal evaluations comparing Chunk-only vs. Graph-only vs. Hybrid configurations.

- Phase 4: Ongoing optimization based on stakeholder feedback and performance metrics.

Results & Business Impact

The shift from standard RAG to Lettria’s Hybrid GraphRAG yielded immediate, measurable improvements in data reliability.

- 95% Extraction Accuracy: Successfully extracted indicators across text, tables, and charts.

- +15 Pt Boost in Correctness: A significant jump in answer accuracy between the initial setup and the first optimized hybrid configuration.

- Zero-Gap Reasoning: Clear superiority in answering multi-constraint questions where information was distributed across multiple documents.

- Audit-Ready Transparency: 100% traceability of reasoning traces, satisfying the stringent requirements of the bank's internal compliance and risk teams.

"Parsing quality was identified as the primary driver of performance. By mastering the layout, we mastered the data."

The Future of Financial Intelligence

This partnership proves that for regulated industries, the future isn't just "Generative AI"—it’s GraphRAG. By combining the flexibility of LLMs with the structure of Knowledge Graphs, Lettria has provided the banking group with a tool that is not only powerful but, more importantly, trustworthy.

Ready to move beyond standard RAG? Book a Demo with Lettria | Explore the Knowledge Studio

.png)